Pratt Center Research

Building Resilient Communities

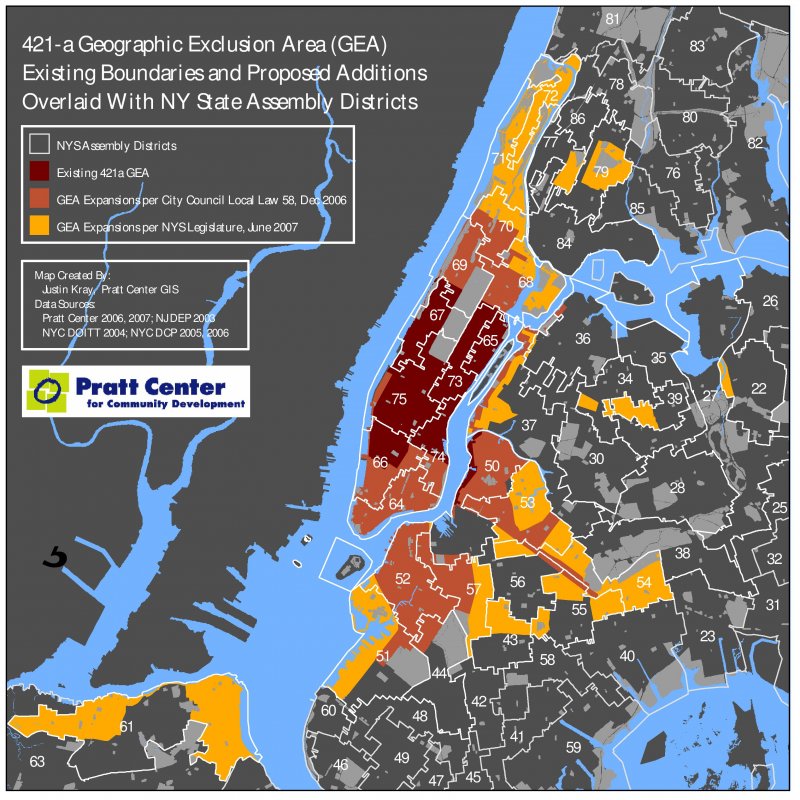

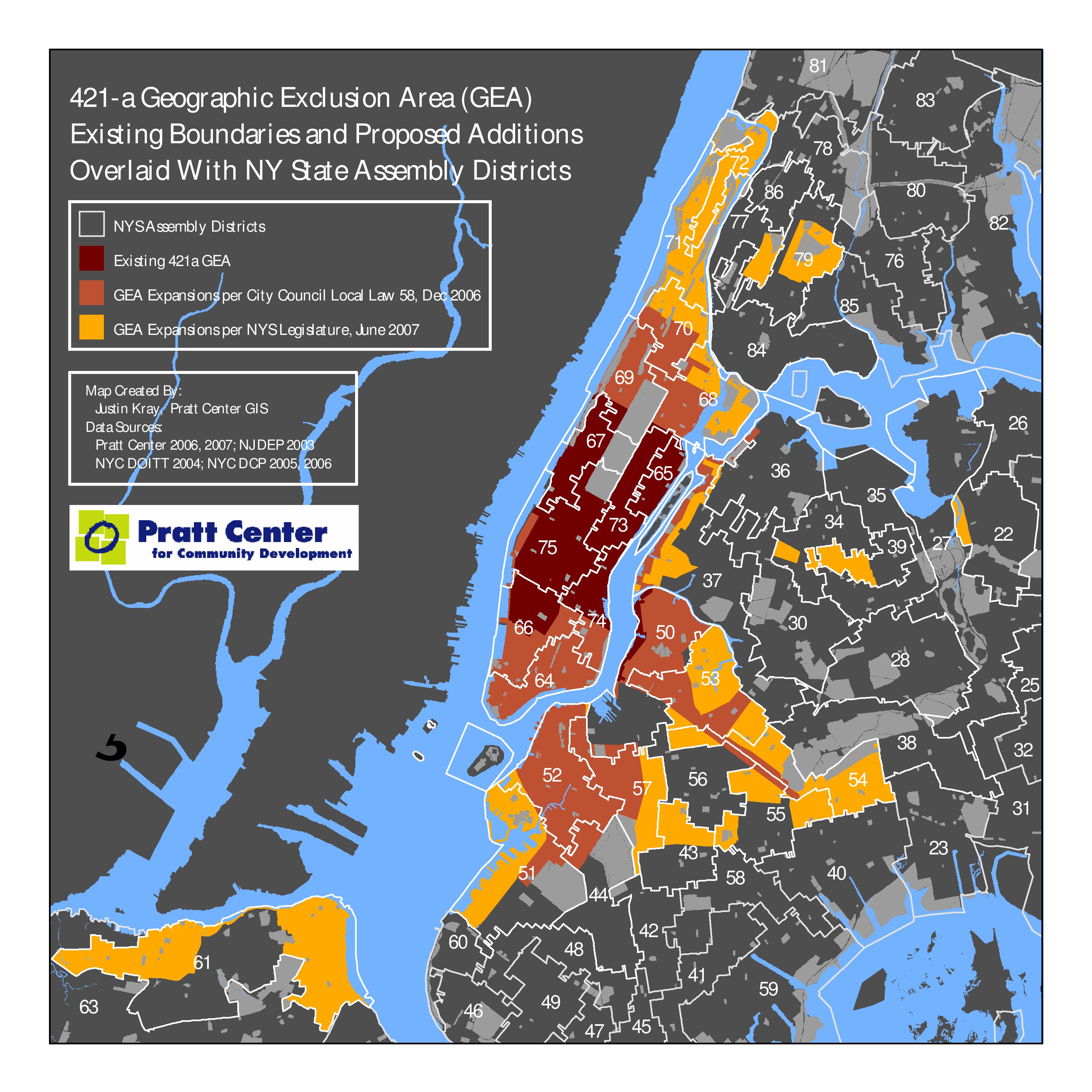

Building Resilient Communities421-a Geographic Exclusion Area (GEA) Existing Boundaries and Proposed Additions Overlaid With NY State Assembly Districts

Maps | May 6, 2009

New York City’s 421-a property tax exemption program was created in the 1970s, when the city was on hard times, to encourage developers to build new housing. In the 1980s, it was adjusted to help encourage affordable housing – so buildings in Manhattan (roughly between 14th & 96th Streets, known as the “exclusion zone”) have to include 20% affordable units in order to receive a tax break. But elsewhere in the city, developers receive a 10 – 15 year “as-of-right” tax break for any new, market-rate, multifamily development. As a result, exclusively high-end buildings in every corner of the city are receiving large tax exemptions.

In 2006, the City is gave $400 million in tax breaks through the 421-a program, with most of that going to subsidize luxury development. In the fall of that year, a task force appointed by Mayor Michael Bloomberg proposed to adjust the program: to expand the “exclusion zone” (where affordable housing is required in exchange for the tax break) to cap the benefits that buildings outside of that zone can receive, and to eliminate the inefficient off-site “negotiable certificates” program.

However, in many neighborhoods in all five boroughs, exclusively market-rate developments – even million-dollar condos – would still receive tax breaks (of up to approximately $107,000 per unit in lifetime benefits. That means a 50-unit luxury building can receive $5.3 million in lifetime tax breaks. Moderate and middle income New Yorkers are paying more in taxes to give a tax break to developers and condo-buyers. While the proposed new exclusion zone covers many neighborhoods where high end development is taking place, there is substantial high-end development outside of that zone.

For more information, click over to Reforming NYC's 421-a Property Tax Exemption Program.